With winter only a few weeks away, the chances are you have already felt the cold air. This is also the time of year where we start using more energy and spending more money – because who wants to sit in a cold house all night?

Many Brits struggle to pay household billsBut it’s not just energy bills that Brits are struggling to pay. New research from prepaid Mastercard icount shows that Brits are also struggling to pay council tax and water bills.

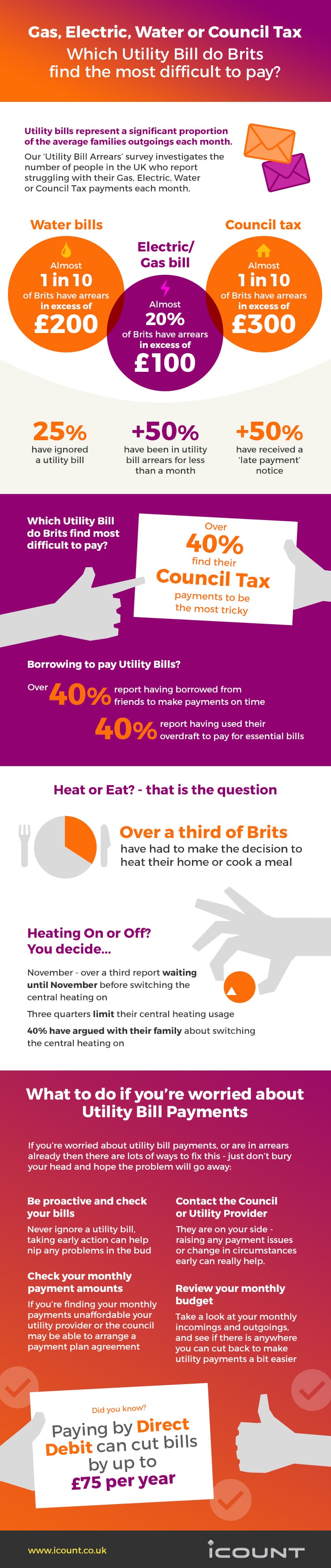

This infographic highlights many of the key difficulties for families trying to finance their homes:

Council Tax

Over 40% of Brits find council tax the most difficult bill to pay. It’s not hard to see why either, when the average council bill stands at a massive £1,484 per year.

The research from icount also showed that 10% of Brits owed more than £300 to the council. This could be due to the fact that council tax payments don’t strike the same immediate fear as having your gas and electricity cut off during the cold winter months.

Heat or eat

There is also the big ‘heat or eat dilemma’, particularly for low income families, the elderly and those with disabilities.

With rising energy prices, over a third of Brits have to make the difficult decision between heating their home or cooking a meal.

These choices can consequently lead to family feuds, with over 40% of Brits claiming they have argued with a family member when it comes to heating the home.

Drowning in debt

Almost 1 in 10 Brits have water bill arrears in excess of £200. Unlike switching energy suppliers relatively hassle free, switching water suppliers just isn’t an option.

This is because the water companies across the UK are only responsible for customers in their set geographical locations. The only way to save money is by cutting back on your usage.

Here are some tips to help you get started:

- Use your dishwasher instead of handwashing – Contrary to popular belief, you actually use more water to handwash dishes than using a dishwasher.

- Scrape your dishes – Instead of using water to rinse dishes, scrape as much as you can into the bin.

- Full Loads – Instead of doing frequent ‘small’ washes, wait until both your dishwasher and washing machine are full.

- Keep your drinking water in the fridge – You won’t waste water waiting for the tap to turn cold.

- Use the microwave to heat water – The flip side of the above point – you won’t waste water waiting for it to get hot.

- Take shorter showers – Try and aim for 5 minutes; you will be saving gallons of water every time.

CEO of iCount, Sam Mond, said: “The sheer amount of people in the UK struggling to pay essential utility bills is worrying. These payments contribute to basic day-to-day quality of life, such as light and warmth.”

Don’t bury your head in the sand

Ignoring your arrears won’t make them go away. The best thing you can do is take immediate action, otherwise the consequences can and will be serious.

The first thing you should do is to contact your utility bill supplier to figure out the best solution. Although this sounds overwhelming, it is in yours and your supplier’s best interests to come to an agreement with you so the money is paid off.

It’s crazy that one in ten people have over 6 months arrears owed on their water bills. The council tax statistic doesn’t surprise me so much, in my experience of the debt management industry it was the one that scared people the most. The moment you start paying for your bills using credit, it’s the start of a very slippery slope!