In the face of soaring mortgage rates, the dream of home ownership may seem increasingly elusive. Yet, it’s not just the financial market trends that influence this dream’s attainability. Your geographical location plays a pivotal role too. A recent study by Cala Homes provides an enlightening perspective on this, revealing how the time it takes to save for a home deposit varies across the UK.

Key Points:

- Location significantly impacts the time it takes to save for a home deposit in the UK.

- Scottish cities offer the quickest path to home ownership, with Aberdeen leading the pack.

- Londoners face the longest wait, with nearly four decades needed to save for a deposit.

- The study by Cala Homes analysed over 130 UK towns and cities.

- The average time to save for a detached home deposit in the UK is 13 years.

- Buying with a partner can halve the time needed to save for a deposit.

The average time it takes to save for a deposit on a home in the UK is 13 years for a detached home, based on the average median price of this property type. A terraced home in the UK will take you just shy of 8 years and nearly 10 years for a semi-detached home. If you’re looking for an apartment, the average saving time is significantly shorter, at just 4 and a half years.

The Average Saving Time Across the UK

| Property Type | Average Saving Time (Years) |

|---|---|

| Detached Home | 13 |

| Terraced Home | 8 |

| Semi-Detached Home | 10 |

| Apartment | 4.5 |

The Scottish Advantage

The study revealed that Scotland is the most favourable region for prospective homeowners. The top five locations with the shortest deposit saving time are all in Scotland. Aberdeen emerged as the most promising city, where a single person earning the median weekly wage of £621.30 could save a 10% deposit for a median-priced detached house (£79,720) in just 2.5 years.

Dundee and Edinburgh followed closely, requiring 4.8 and 4.9 years, respectively, to save for a 10% deposit. The median detached house prices in these cities are £141,260 and £163,920, respectively.

The Best of the Rest

Outside Scotland, the cities offering the shortest saving times include Belfast (5.2 years), Hartlepool (7.9 years), and Doncaster (8.4 years). It’s worth noting that these figures represent the saving time for a single person. Couples or joint buyers could potentially halve this time as they can combine their savings and avoid bad spending habits as the cost of living rises.

The London Home Ownership Challenge

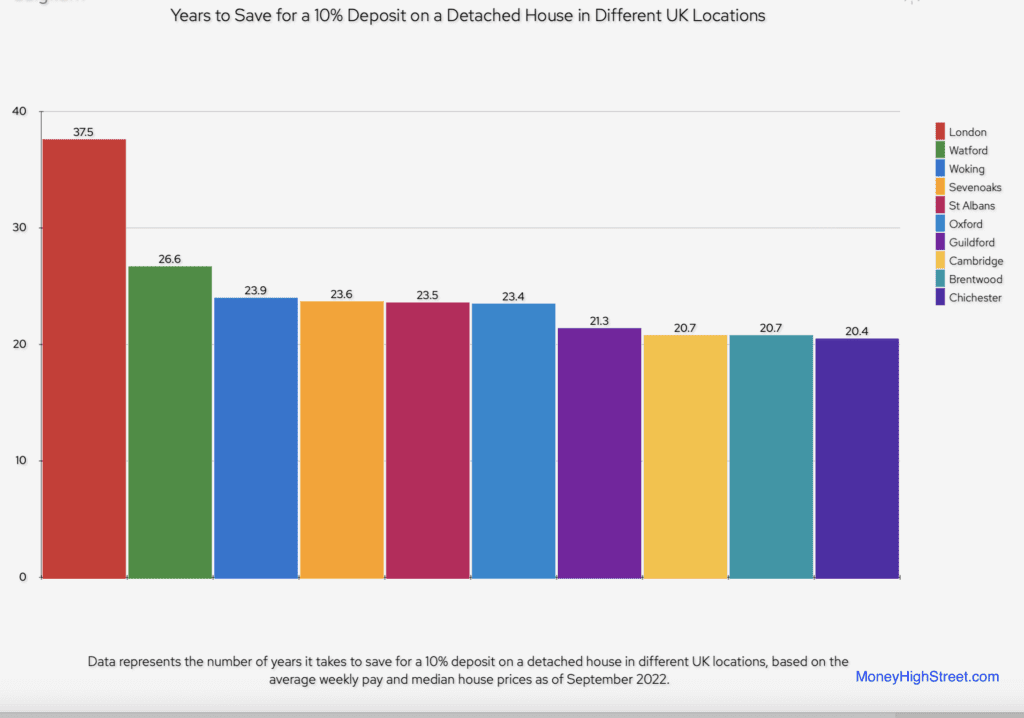

Unsurprisingly, London topped the list of locations with the longest saving time. Despite a median weekly salary of £747.40, a single person would need a staggering 37.5 years to save a 10% deposit for a median-priced detached house (£1.49m). Watford and Woking, known for their proximity and excellent transport links to London, followed with 26.6 and 23.9 years, respectively.

Glenn Copper, Sales & Marketing Director for Cala Homes (North Home Counties) said: “Against the backdrop of a housing and cost of living crisis, Deposit Unlock could offer more people an opportunity to own a new home by giving them access to low-deposit mortgages. It could also help buyers to significantly reduce the time it takes to save for a new home, and it isn’t just for first-time buyers, the scheme is open to home movers and those looking to return to the market following separation or divorce.

“If you are currently paying money towards your rent and you would prefer to pay this towards buying a new home, then it could be worth exploring what Deposit Unlock could do to make buying a new home more affordable for you.”